7 Steps for a Successful 1031 Exchange: Tips from a Qualified Intermediary

How to Complete a Successful Forward Exchange

If you're looking to sell a property and purchase a new one without paying taxes on the sale, a forward 1031 exchange may be the right option for you. Like-kind exchanges were put in place by Section 1031 of the Internal Revenue Code. In a forward exchange, the sale of the old property comes first, followed by the purchase of a new one. However, completing a successful forward 1031 exchange can be a complex process that requires careful planning and attention to detail, so you should take into careful consideration the QI you use.

In this guide, we will provide you with the necessary steps to ensure your forward 1031 exchange is successful, and we will highlight the importance of using a qualified intermediary (QI). We will also introduce you to a capital gains calculator that can help you estimate your tax liability.

Step 1: Understand the Basics of a Forward 1031 Exchange

A forward 1031 exchange allows you to sell a property and use the proceeds to purchase a new property without paying taxes on the sale. However, there are strict guidelines and regulations that must be followed to complete a successful exchange. It's important to understand the basic requirements and rules of a forward 1031 exchange before getting started.

Step 2: Use a Capital Gains Calculator

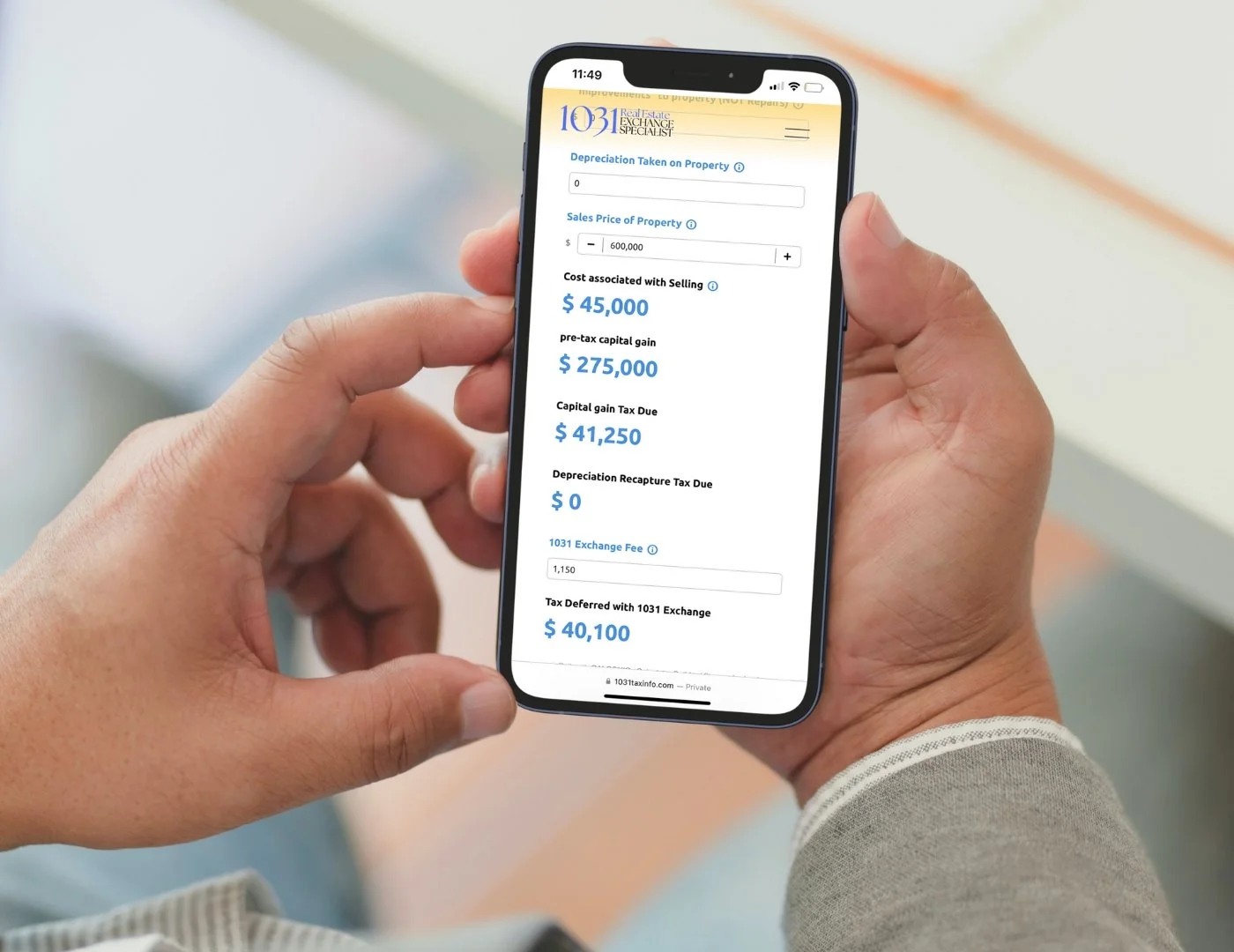

A capital gains calculator can be an incredibly helpful tool in estimating your potential tax liability. It can help you calculate both capital gains taxes and depreciation recapture taxes. As of 2023 tax laws, the capital gains tax rate ranges from 0% to 20%, depending on your income level. Depreciation recapture taxes are typically taxed at a rate of 25%. Its also important to note that your state may also impose a tax on your capital gain.

Use our Capital Gains Calculator and see how much you could save with a 1031 Exchange.

Step 3: Identify a Qualified Intermediary

One of the most important steps in a successful forward 1031 exchange is to work with a qualified intermediary. A qualified intermediary is an independent third-party who facilitates the exchange and ensures that all regulations and guidelines are followed. As a qualified intermediary, we can provide guidance throughout the entire process and help you avoid common pitfalls.

Step 4: Consult with a Tax Professional

Before starting a forward 1031 exchange, it's important to consult with a tax professional who can advise you on your specific situation. They can help you determine your potential tax liability and provide guidance on how to structure the exchange to minimize your tax liability.

Step 5: Sell your Relinquished Property

If you are doing a forward exchange, then you will first sell your property. Your Qualified Intermediary should be in contact with the closing team for the sale of your relinquished property, and the exchange documents will likely be signed at closing. After the sale, the funds from the sale will be held in an Escrow or Trust Account by your chosen QI.

Step 6: Identify Replacement Properties

To complete a successful forward 1031 exchange, you must identify replacement properties within 45 days of selling your existing property. It's important to have a clear understanding of what you're looking for in a replacement property and to work with a qualified real estate agent to find suitable properties.

Step 7: Complete the Purchase of the Replacement Property

After you've sold your existing property and the 45-day identification period has passed, it's time to close on the purchase of your replacement property. This must be done within 180 days of selling your existing property, and the purchase must be completed through your qualified intermediary. Once the purchase is complete, you have successfully completed a forward 1031 exchange.

A 1031 Exchange Shouldn’t be Scary or Difficult.

Completing a successful forward 1031 exchange can be a complex process, but by following these 10 steps and working with a great qualified intermediary, you can achieve a tax-efficient transition from one property to another. To ensure your exchange is done correctly and according to IRS rules and regulations, you must ensure your QI is knowledgeable and dependable.

Also, remember to consult with a tax professional, identify suitable replacement properties, negotiate the purchase price, and use a capital gains calculator to estimate your tax liability. By doing so, you can ensure that your exchange is completed within the required timeframes and according to the regulations and guidelines set forth by the IRS, you can also ensure you save the most money.

“"At 1031 Real Estate Exchange Specialist, we are dedicated to helping our clients navigate the complex world of 1031 exchanges. As a Qualified Intermediary, our mission is to provide expert guidance, support, and education to ensure our clients make informed investment decisions and reach their financial goals. We are always available to answer any questions and assist in any way we can. Thank you for choosing us.”

1031 Real Estate Exchange Specialist