North Dakota 1031 Exchange: A QI’s Guide

For real estate investors in North Dakota, a 1031 exchange is a valuable tool for maximizing returns while minimizing tax liabilities. This guide will delve into the nuances of 1031 exchanges in North Dakota, highlighting investment property types prevalent in the state and offering strategic insights for successful exchanges.

Investment Property Opportunities in North Dakota

North Dakota's diverse real estate market presents various investment opportunities suitable for 1031 exchanges:

Residential Rental Properties:

With a robust rental market in cities like Fargo and Bismarck, investing in single-family homes and multi-unit buildings offers attractive returns and steady demand.

Commercial Buildings:

The state's commercial sector, especially in oil-rich regions, has seen growth, making properties like office spaces, retail locations, and industrial warehouses appealing investment choices.

Agricultural Land:

As a leading producer of crops, North Dakota's agricultural land is a valuable investment. The state's vast farmlands are ideal for investors seeking to diversify their portfolios in the agricultural sector.

Mineral Rights:

The abundance of natural resources, including oil and gas, creates opportunities for investing in mineral rights, with potential for earning royalties from resource extraction.

Nuances of 1031 Exchanges in North Dakota

Understanding the specifics of conducting a 1031 exchange in North Dakota is crucial:

Property Tax Considerations:

North Dakota boasts some of the nation’s lowest property tax rates, an attractive feature for investors. However, tax rates can vary across the state, so thorough research into local rates is essential.

Like-Kind Exchange Rules:

Federal law governs like-kind exchanges. It’s important to ensure that the properties involved in your exchange meet these specific criteria.

Tips for a Successful 1031 Exchange in North Dakota

Maximize the potential of your 1031 exchange with these strategies:

Advance Planning:

Successful 1031 exchanges require meticulous planning. Engage with a qualified intermediary early and collaborate with real estate professionals to find suitable replacement properties within the exchange timelines.

Local Market Research:

In-depth understanding of North Dakota’s real estate market is key. Explore various investment options and assess factors like location, rental demand, and growth potential before committing to a property.

Maintain Detailed Records:

Keeping comprehensive records of all transactions is crucial for organizational purposes and to ensure compliance with tax regulations.

Professional Tax Consultation:

Given the complexities of 1031 exchanges, consulting with a tax professional is advisable to navigate the tax implications effectively and to ensure adherence to both state and federal laws.

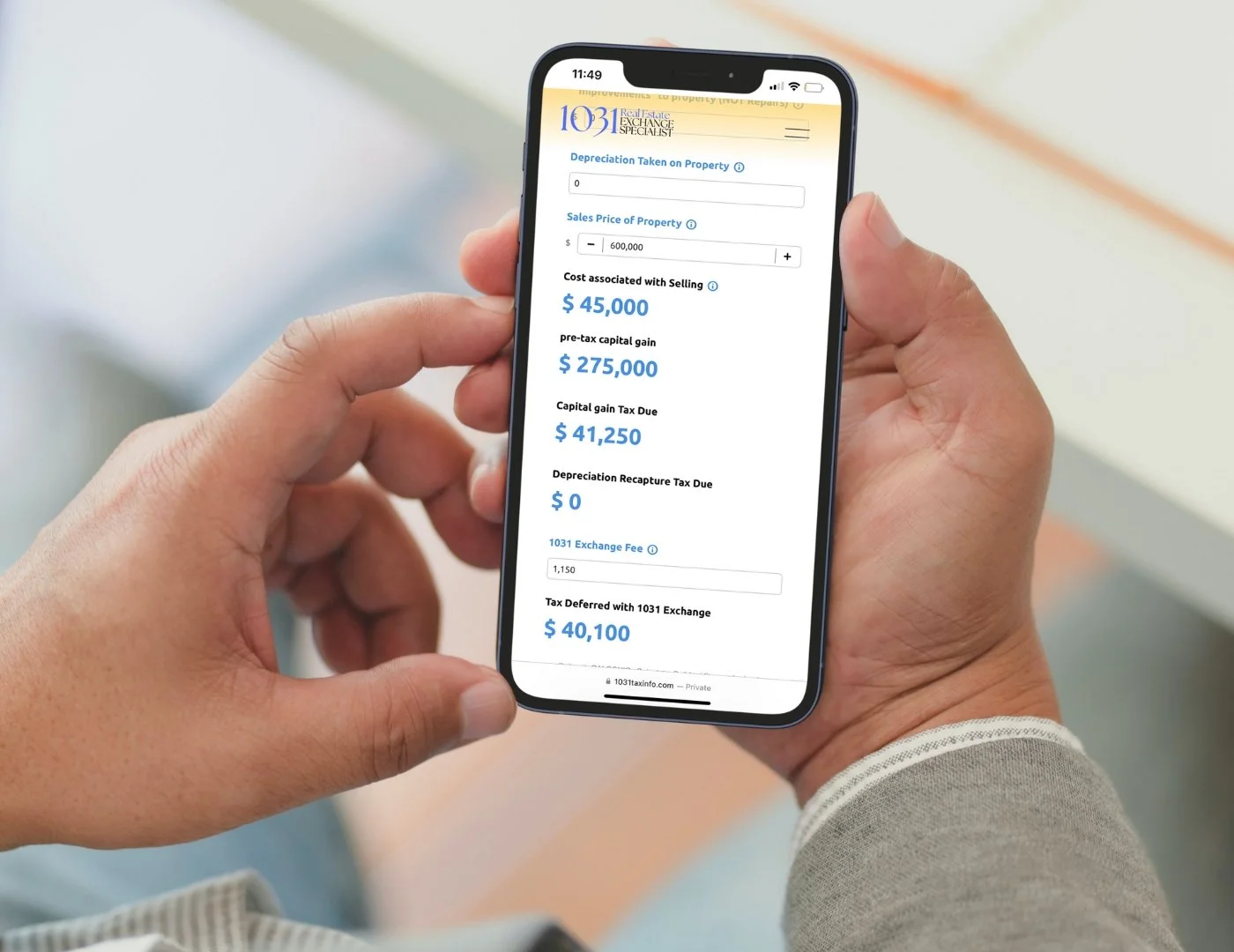

Try using our Capital Gains Calculator to see how much you can defer with a 1031 exchange.