Investing in Arkansas Real Estate: Your Guide to 1031 Exchanges

Are you contemplating a real estate investment in Arkansas? If so, the 1031 exchange might be an essential tool to consider. This provision allows investors to defer capital gains taxes from the sale of an investment property by reinvesting the proceeds in another property. Here, we delve deeper into the intricacies of 1031 exchanges in Arkansas.

Types of Investment Properties in Arkansas

Single-family homes:

Predominantly found in Arkansas, these properties serve as an excellent starting point for new investors due to their affordability and maintenance ease.

Multi-family homes:

While they can yield higher rental income than single-family homes, they often demand more maintenance and management.

Commercial properties:

Encompassing office spaces, retail outlets, and warehouses, these properties can offer significant rental returns but might be accompanied by elevated maintenance costs.

Land:

Undeveloped land offers an investment avenue for those banking on property appreciation or future construction projects.

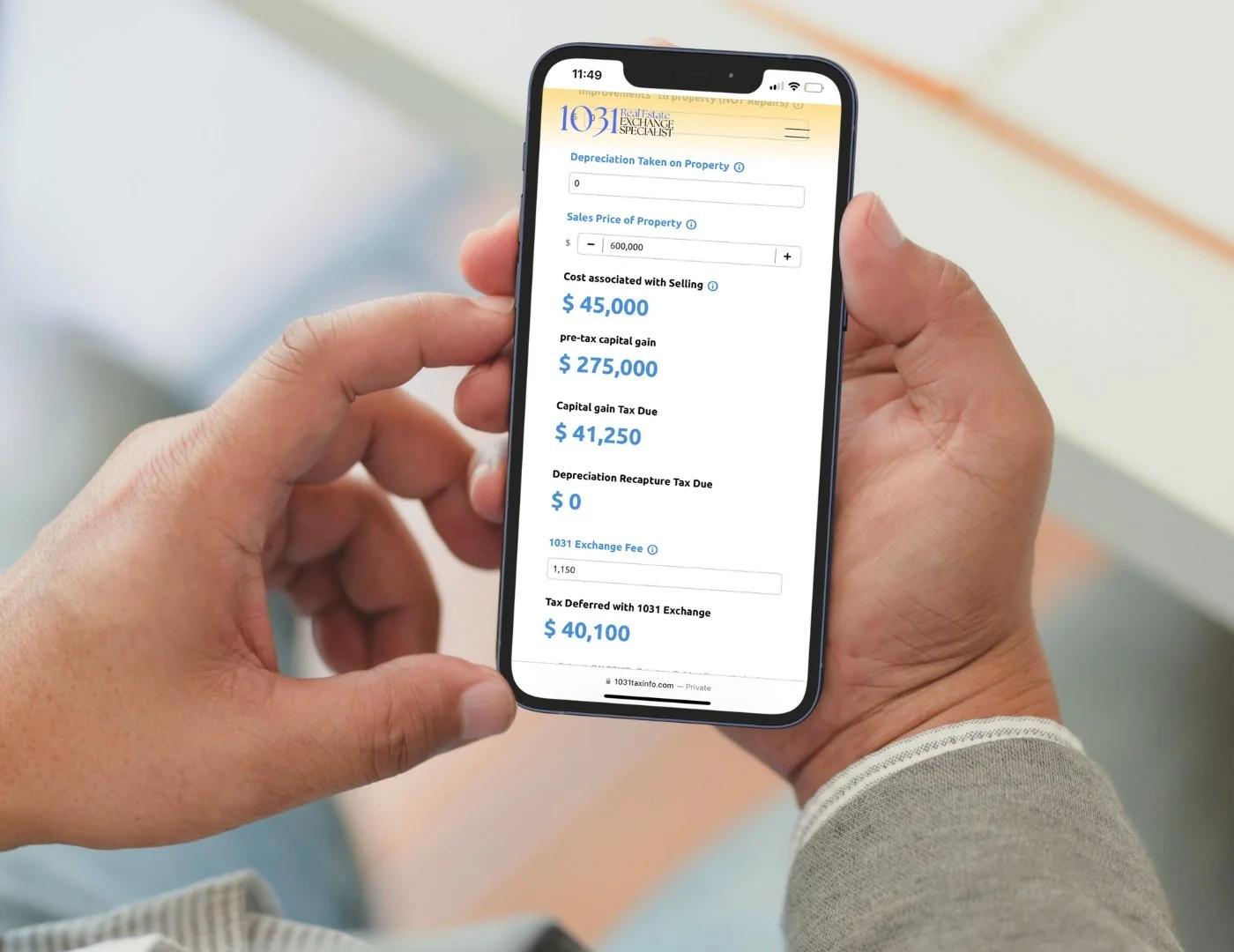

Calculate your capital gains liability using our free calculator.

Nuances of 1031 Exchanges in Arkansas

State Taxes

Although Arkansas doesn't impose a specific capital gains tax, it does levy an income tax. Therefore, the sale of your property might still be subject to federal capital gains taxes. Using the 1031 exchange provision can assist in deferring these taxes.

Replacement Property Options

Arkansas provides a myriad of options for those seeking a replacement property. From single-family homes to commercial entities, investors are spoilt for choice.

Rural Development

By investing in Arkansas's rural sectors, investors might qualify for rural development loans and grants provided by the U.S. Department of Agriculture (USDA).

Unique Property Choices

Arkansas boasts distinct investment opportunities such as historical buildings or properties vested with mineral rights.

Steps to Undertake a 1031 Exchange in Arkansas

Sell your existing property:

A prerequisite for a 1031 exchange is the sale of your current investment property.

Identify the replacement property:

Post the sale of the original property; investors have a 45-day window to earmark a replacement property.

Acquire the replacement property:

This property needs to be purchased within 180 days of selling the original property.

Collaborate with a qualified intermediary:

To ensure your 1031 exchange aligns with IRS stipulations, partnering with a proficient intermediary is crucial. They oversee the exchange's intricacies.